A new telephone study suggests that a substantial percentage of Americans are unfamiliar with fairly routine terms used to describe various aspects of health insurance.

The poll, which was commissioned by the American Institute of CPAs and carried out by Harris Interactive, revealed that over 52 percent of respondents couldn't accurate define what a premium, deductible or co-pay were. For example, nearly one-third falsely identified a premium as being the cost of receiving treatment from a primary care physician. Additionally, more than one in four – 27 percent – thought that a co-pay was the total expense of a health insurance policy.

Ernie Almonte, chair of the AICPA's financial literacy commissioned, noted that if many consumers were to take a pop-quiz on health insurance terms, they wouldn't do well.

"Half of Americans would fail health insurance 101," said Almonte. "That's critical insight as consumers prepare to make important decisions with implications for both their physical and fiscal well-being."

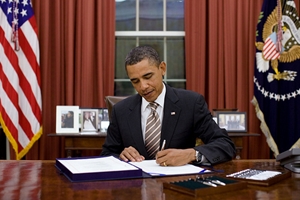

Something else that respondents were less than familiar with was the Patient Protection and Affordable Care Act. According to the survey, 41 percent said they were "not at all" knowledgeable about the ACA and 48 percent said they were "somewhat" knowledgeable. The younger respondents were, the more likely they were not to be well-versed on the ACA. For example, nearly 50 percent of 18-to-34-years olds said they didn't know much about it.

In a separate poll performed by Prince Market Research, unawareness was fairly common for people with respect to their employee benefits. The survey found that approximately three-quarters of workers "sometimes" or "never" comprehend everything that's included on their insurance plan. With the health reform law going into full effect shortly, 37 percent said they expect their policy to become more complicated than it already is.